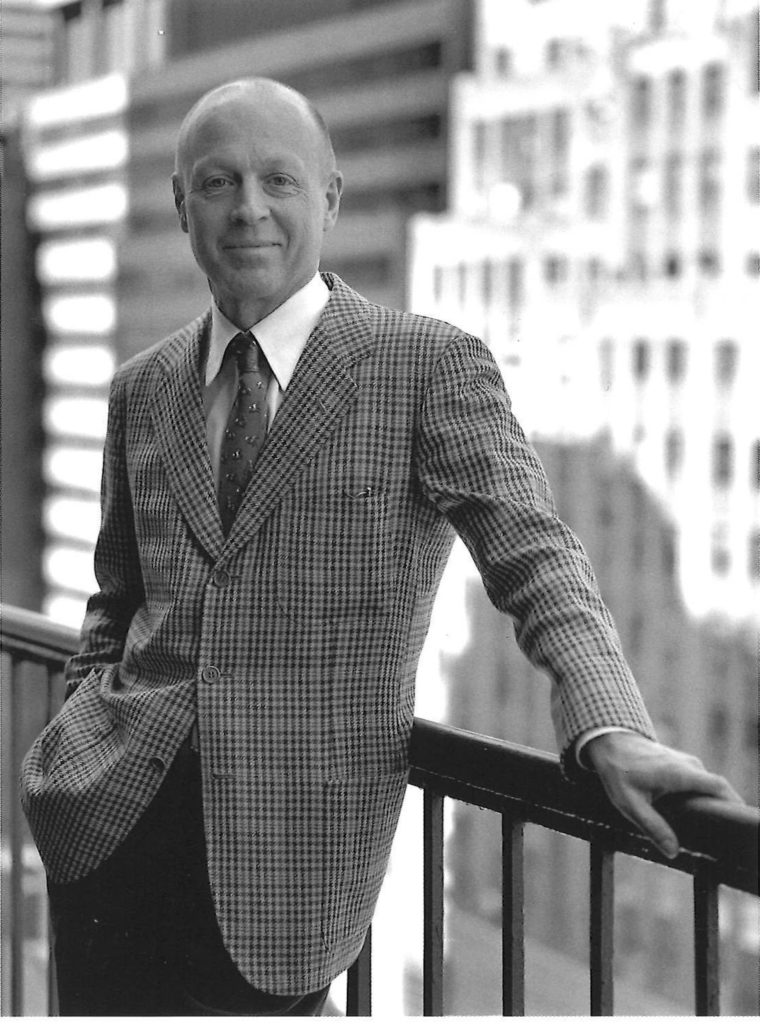

Can I help you find something? Kenny Schachter presiding over his Sotheby’s sale. Courtesy of Kenny Schachter.

How can you make a small fortune in art? Start with a big one. I’m paraphrasing Victor Gauntlett, a onetime owner of the perennially cash-strapped sports car manufacturer Aston Martin. Yes, like in any business, you can make lots in the art market if you are ruthlessly, single-mindedly focused on money. There’s always an exception, like Elon Musk in cars and the art dealer Jeffrey Loria, who parlayed his profits from selling Picassos (and more) to buy the Miami Marlins baseball team, which he subsequently sold for $1.2 billion in 2018. Sadly, for my family anyway, I’m not one of these guys. Incidentally, Loria got his start at the Sears department store in the art-buying program started by the actor Vincent Price, and now at 80 he’s returned to it. (Art-dealing, not Sears.)

Which brings me to my second annual Hoarder sale at Sotheby’s. This past December, I launched a single-owner online auction and exhibition at Sotheby’s New York headquarters that featured 120 lots ranging from jewelry, a car, and a boxing glove to a broad cross-section of contemporary art, all from 1970 to 2017. (I consider three years a long enough—though admittedly arbitrary—holding period to, in my mind, preclude a sale from constituting a flip.) The estimates ranged from a measly $300 (who said art is expensive?) for works by the former collective Dearraindrop, Alix Lambert, and Theo Rosenblum (son of artist Jane Kaplowitz and curator Robert Rosenblum) to $180,000 for a Ken Price. And, most significantly for a sale with an overall estimate of $1.2 million to $1.6 million, nothing carried a reserve, meaning any winning bid would take home the lot no matter how small. In other words, my loss could be your gain—and it was.

Perhaps you might be interested in a Nick Cave? Courtesy of Kenny Schachter.

Though I have yet to tally the total P&L for the sale, it’s safe to say I came out substantially in the red. But, like many a long-term art world veteran, I am up to my ears—and storage facilities—in art. It’s collecting as calling. And I’m hardly alone in being a hoarder. One well-known dealer (who might have a gallery in SoHo) confirmed an annual storage bill of $800,000. And, as my personality limitations (lack of patience and interpersonal skills) prevent me from selling directly to collectors for the most part, these overflow auctions are the perfect business model for me. In a sense, I’m chasing my own tail, buying to sell, selling to buy, but I really need some liquidity events that in turn enable the teaching, writing, and art-making that give meaning to an otherwise fairly futile life.

During the course of my auction, I kept office hours on the sales floor—making it the first time in Sotheby’s illustrious 276-year history that a consignor also physically engaged in peddling their own wares. (They told me so.) The whole enterprise had the same improbable, anything-goes, seat-of-the-pants vibe as one of my early 1990s curatorial efforts in recession-stricken New York. The artists ranged from conceptual stalwarts like Chris Burden and Dan Graham to sculptor Curtis Cuffie, who formerly resided on the streets of the city where he erected wild installations of manipulated garbage and sold them piecemeal to passersby.

Why not take it for a spin? Courtesy of Kenny Schachter.

In the end, 47 percent of the 99 total buyers were new to Sotheby’s; out of 504 bidders, 205 of were also new (or 41 percent), which constituted the highest percentage of new buyers at any of the auction house’s contemporary online sales this year—which, considering there were 300 such sales, is nothing to sneeze at. Winning bidders hailed from 15 countries, including Qatar and the Philippines. The auction was largely marketed on social media, which along with the lack of reserves and the accessible price points accounted for enticing new bidding blood to the house. Records were set for 17 artists: Rene Ricard, Eliza Douglas, Walter Robinson, Curtis Cuffie, John LeKay, Forcefield, Dan Asher, Gideon Rubin, Misaki Kawai, Chris Burden (for a work on paper), Michael Scott, Susan Smith Pinelo, Evan Robarts, Theo Rosenblum, Tommy Stockel, and even me, albeit for $4,000, but hey, it’s a start!

Artnet visionary Hans Neuendorf in 1995. Photo courtesy of artnet.

Artnet was founded as Centrox in 1989 by Pierre Sernet (a French collector with a name purpose-built for the internet) and ultimately invested in, and taken over by, Hans Neuendorf in the early 1990s, with them ruling the roost ever since, for nearly three decades. Though the company went public in 1999 on the Frankfurt stock market, the Neuendorf family has remained majority shareholders. Jacob Pabst, Hans’s eldest son, has been CEO since 2012. In that very year, Sergey Skaterschikow, an intermediary acting on behalf of the Russian investor Vladimir Yevtushenko, attempted a corporate coup with the assistance of Rüdiger Weng, a German online print dealer. They began accumulating shares and attempted to install a board majority to wrest control from, and oust, the Neuendorf family. I can’t put it better than Hans himself, describing the first skirmish in a memo posted on the Artnet investor relations page:

“In 2012, Mr. Weng participated in an attempted takeover of artnet by Sergey Skaterschikow, who tried to gain a foothold in the Western art market with money from a Russian oligarch and Putin confidant. On Skaterschikow’s behalf, professional troublemakers were hired, who succeeded in drawing out the Annual General Meeting until almost midnight. It was Mr. Weng who capped the disgraceful spectacle shortly before midnight by stepping onto the podium and snatching the paper with the voting results from Prof. Dr. Rust, the meeting chair and Chairman of the Supervisory Board, to prevent him from announcing them before 12 a.m., in which case the Annual General Meeting would have had to be repeated at a high cost. Mr. Weng dashed towards the exit but was outrun by Dr. Becker, our lawyer, who ripped the now crumpled paper from him and handed it to Prof. Dr. Rust so that he could read out the results before midnight. Even eight years later, it remains a breathtaking story!”

Now, eight years after that scene, Weng—who fancies himself a master market manipulator, and who has been obsessed with Artnet’s potential since its creation (in part because he sees it as a potential vehicle to sell the low-quality prints he hocks)—struck again in December after accumulating enough shares to increase his ownership to constitute a little over 25 percent of Artnet’s voting rights. (The Neuendorfs retain around 28 percent of the outstanding shares.) Weng’s company is substantially smaller than Artnet’s, with a staff of six versus Artnet’s 110 full-time employees, but through some feat of legerdemain its market capitalization of €52.8 million is larger than Artnet’s current (vastly undervalued) €41.6 million market cap. At the shareholder meeting on December 15th, Weng was thwarted in his attempt to gain a board majority and overthrow the Neuendorfs, but successful—for now—in complicating their initiative to raise cash and dilute his shareholdings. Though the Neuendorfs managed to win the day and maintain their control of the company, Artnet remains a very attractive investment target (and not only because I write for it). The art world’s retreat online has played into Artnet’s favor, and business is more robust than ever with online art sales up 25 percent year to date and 67 percent in November alone.

On another note, here’s a new one that popped into my inbox: “I am interested in being introduced to people that have information that can lead to prosecuting significant art related tax frauds, particularly those that touch NY. I’m also interested in learning about new or more obscure art related tax schemes I’m not currently aware of. The whistleblowers are frequently interested in pursuing these cases because both the federal government and NY pay large bounties for strong evidence that leads to recoveries. Sometimes, the whistleblowers can remain anonymous as well. So, that would be my agenda for a further discussion. If this sounds interesting to you, I’d love to talk. Joseph Gentile of SARRAF GENTILE.” I can think of 100 other internet scams I’d rather lose money and face in than be a party to such an entreaty. And what a name, Gentile (defined as non-Jew for you non- Jews); was this some kind of bad joke? If they didn’t have a legitimate website and some press, I’d think it was straight out of Woody Allen’s next movie. Oy.

While I’m complaining, here is a note to every gallery in existence: stop sending me Merry Christmas emails—it’s no more than digital fucking pollution, basta! Lest I forget, ceramics are the new neon; everyone seems to have gotten their heads stuck in a kiln. I propose a moratorium for 2021. During quarantine, I have learned more (than enough) about wet yeast starters that could cure for decades before transforming into the perfect loaf; “proofing” is the nomenclature for the process where the dough is allowed to rest and rise a final time before baking. Too bad art isn’t allowed the same breathing space to grow and take root (like it used to) before we all snap to judgment and gobble it up for millions.

Starter yeast for yet another sourdough loaf, which might cure for decades. Why isn’t art given the chance to accrue meaning before it’s over-speculated on? Courtesy of Kenny Schachter.

In any case, I am happy to let those spam-sending galleries know that I did, indeed, enjoy the holiday season. I was able, after a little persuasion at the border, to slip into Switzerland, where my family had congregated months before. The gallery scene in St. Moritz (where my wife’s family resided for nearly 50 years) remains vigorous even though it feels like there are more galleries than people. It’s almost a relief that the exorbitantly priced hotel restaurants are closed except for guests (with the rest of the town’s restaurants simply shut), which saves me the indignity of willfully getting ripped off on a regular basis. For a sense of the pornographic wealth on display in this cosseted enclave in the Swiss Alps, there is the grotesque house that took the Polish entrepreneur Jan Kulczyk almost a decade to build, replete with walls lined in mink, cashmere, and 24-karat gold and floors swathed in fox fur. Really—if there was ever an explanation of post-capitalism that I could understand, this is it. As if by an act of god (or karma) Jan died before he could take possession of his residence, and the house of horrors (literally) languishes on the market for $185 million. Anyone interested? By the way, Jan’s billionaire ex, Grażyna Kulczyk, opened a museum in nearby Susch featuring primarily female artists, so all is not so profligate.

The St. Moritz house of horrors, if you have any sense of aesthetics or are an animal with a fur—many a deceased mink and fox line the walls and floors of this literal monstrosity, Switzerland’s most expensive house. Courtesy of Kenny Schachter.

Speaking of licentiousness, I couldn’t think of a more perfect setting for the king of bling (art) Damien Hirst, whose big blob of bronze entitled The Monk is plopped onto the lake in the center of town; the 2014 sculpture is part of a larger group of works said to be valued at over £40 million that will be spread throughout four locations in St. Moritz later this month. During the installation of this big-assed Buddha, which was airlifted in via helicopter, an unholy gust of wind nearly Richard Serra-ed (i.e., crushed) a handful of technicians to death. Though it has been reported that the artworks aren’t for sale but rather just part of an exhibition partially funded by the town and the dealers Marco Voena and Oscar Humphries, my intel has informed me otherwise. Get ’em while they’re cold.

Another art behemoth rolled into town for the proceedings and a show at Vito Schnabel Gallery… his dad Julian. Between the Neuendorfs and Schnabels, all that’s missing is another in the series of shows I’ve curated over the years with my kids. People like their holiday plates full and their Schnabel’s full of plates. Julian showed a new series of dishware landscapes and trees, which fared much better than his recent outing at Pace—four of the six works sold at the time of this writing with an asking price of $475,000 a pop. At that level, compared to the primary prices many of his younger counterparts fetch—like Jonas Wood ($1 million-plus), Joe Bradley ($1.2 million), Adrien Ghenie ($1.2 million-plus) and George Condo ($3 million-plus)—it begins to make a lot of sense. Julian’s oversized personality and boundless sense of self-aggrandizement has done nothing to bolster his market; when he passes, his prices will probably surge just because he won’t be around to remind us of just how great he is all the time.

Larger than life—“the Julian,” not me (though I have put on tons of weight over holidays). Courtesy of Kenny Schachter.

Hauser & Wirth was chock-a-block full of Phillip Gustons (can’t wait for their next hotel to open here, eye-roll), with prices ranging from $800,000 for a work on paper mounted to canvas from 1962 titled The Actors to $10 million for a canvas depicting some gangly legs and feet. The director of the local St. Moritz Hauser branch, Stefano Rabolli Pansera, got separated from his wife and child under London’s never-ending lockdown—a Covid orphan—so I took him in like a stray and invited him to our house for a series of meals. Shocking though it seems, even the art world has heart (on occasion). My favorite dealer is the curmudgeon Karsten Greve, longtime representative of Cy Twombly, Lucio Fontana, Joel Shapiro, and Louise Bourgeois. The man is as intrepid as ever and is never not working—he was toiling away in his gallery late one dreary Monday afternoon, masked and at the ready, planning his next forays at his galleries in Paris, Cologne, and St Moritz. I love him.

The masked crusader Karsten Greve, with one of his Pierre Soulages. He’s never not working, a trait I admire and aspire to. Courtey of Kenny Schachter.

I came to the realization that I am a-seasonal—I’m not bothered about anything as long as there is art at hand. Like Karsten, I don’t do downtime, and abhor holidays. I was thrilled to be asked to curate a selection of works from eight local galleries for the Nomad fair, a peripatetic design and art event established in 2017 by Giorgio Pace and Nicolas Bellavance-Lecompte, which will take place in nearby Samaden in February of this year (an anomaly, as there won’t be major fairs till the end of 2021 at the earliest in my estimation). I am also taking part in E.A.T. (Engadin Art Talks), the 10-year-old initiative in the region with an illustrious team of curators and veteran art professionals including publisher Cristina Bechtler, Foundation Vincent van Gogh Arles artist director Bice Curiger, and Hans Ulrich Obrist of… everywhere.

The hardest job ahead is that I control myself and focus on writing, teaching, and making art rather than buying it. I need to hoard some money (look for my next Sotheby’s auction coming soon) for the time being to find a permanent place to live in New York. Seems I’m not the only person fishing for dollars: Yusaku Maezawa, owner of the $110 million Jean-Michel Basquiat, has put his other Basquiat (bought from Adam Lindemann at Christie’s in 2016 for $57,285,000) back on the market for $90 million this time around. Maybe he should buy the Jan Kulczyk mink house up here. And with that, I bid you (get it?) a happy, healthy, and prosperous New Year!