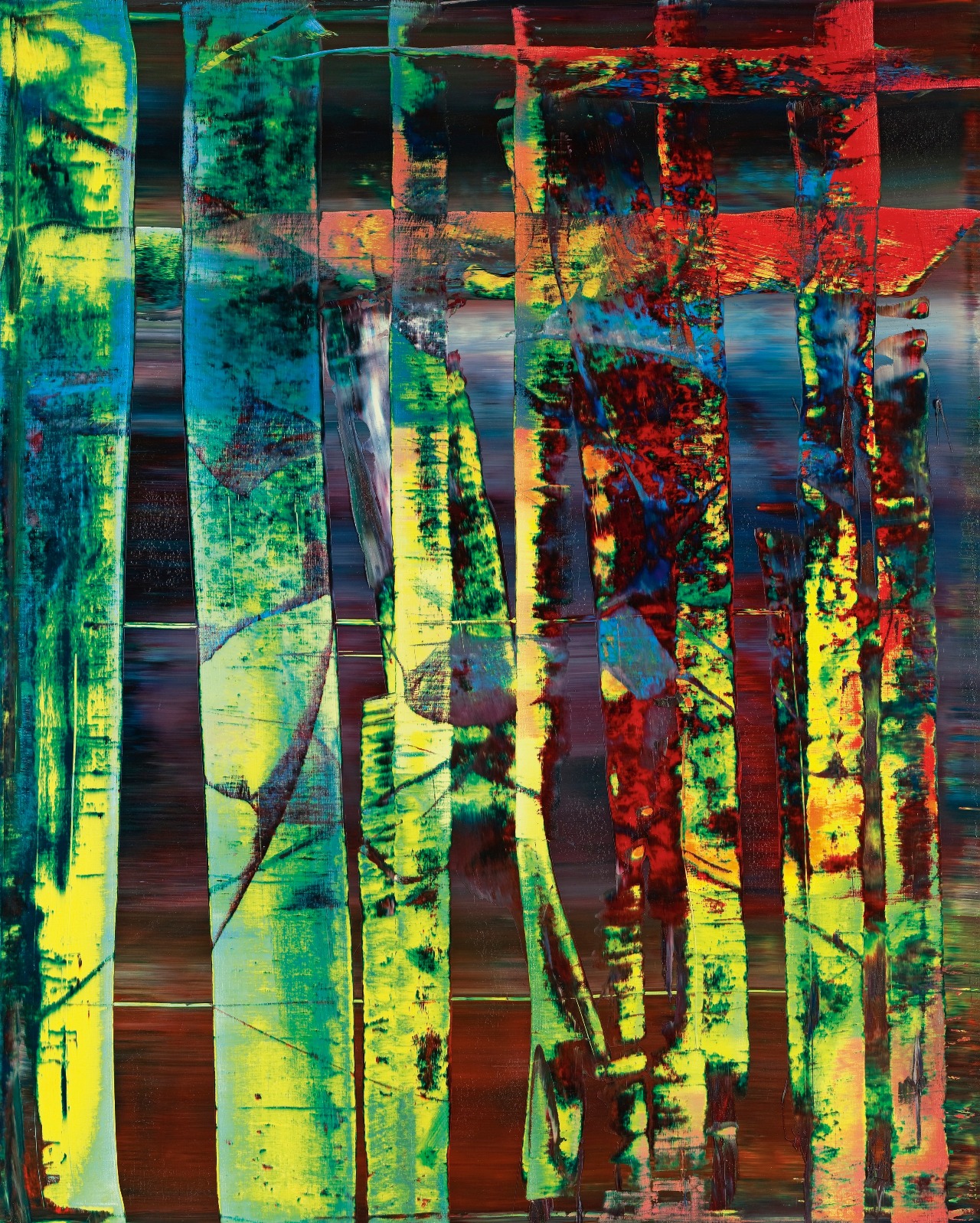

Gerhard Richter, Abstraktes Bild, 1992.

$ 1,248,000. Sotheby’s New York, May 10, 2005.

$14,082,500. Sotheby’s New York, Nov. 9, 2011.

Why do so many art people seem to be hoping for an art crash? Why can’t they accept that in these uncertain, unstable times art has elevated meaning and value? And that the global breadth of the collecting universe has grown exponentially, which is an underlying fundamental that Warren Buffet could appreciate. Says Charlie Finch in Artnet Magazine, “I predict that, in six months, art prices will be down, across the board by 50 percent, falling faster with no takers.”

Well, I have news for the naysayers, if you think you will ever be able to purloin a Picasso at that price, dream on. What’s more, I have a prediction of my own, that in six months time you will see that art has continued its inexorable march higher.

History offers plenty of occasions in which artists have profited handsomely from their works during their lifetimes. But today, more and more, we are faced with a kind of esthetic McCarthyism directed against the happy bedfellows of art and money. Wake up, everyone, this is a love/hate relationship that is ancient beyond time, it only appears to be much more pronounced now.

Make no mistake, squeezing money out of art, like spinning straw into gold, is an alchemical transformation that doesn’t always go according to plan. As the global financial picture grows bluer than a 1904 Picasso, the art market suffers from a double dilemma, a classic fence-straddle: collectors don’t want to sell because they have nowhere else to stash their cash, and they don’t want to buy, since they fear a crash coming around the corner of the next art fair aisle.

Art is incontrovertibly an asset class, unless you actually need to convert it to money in anything resembling a hurry. Yes, art is a store of value, but it is a beast with a peculiarly unforgiving bite. Many variables need to fall into place to profit in a universe where the sought-after objects are characterized by a seemingly random collision of fashion, fun, fate and fuck-all.

Working within the quirky confines of the art world is both exhilarating and exasperating. The business has functioned much the same for centuries, two people having a meeting of the minds, really nothing has changed since wampum was traded on a beach in the 15th century or before. As a result, art is not the most efficient of markets and information is as much shielded as shared. I have seen transactions between the best of friends where, unbeknown to either, the deals were orchestrated by intermediaries.

Who prospers from this global art minefield? The lawyers of course, but also the feeding system of dealers, collectors, artists, hangers-on and mere spectators. Art is one of the last sectors where it is possible to attain short-term, double-digit returns (see illustrations) — no wonder the high-end art market is an economic powerhouse and, after all these years, the best and last free lunch in town.

Gerhard Richter, Mao, 1971. € 783,500 ($1,004,487), Villa Grisebach Auktionen, Berlin. May 26, 2006. £1,308,000 ($2,584,980), Christie’s London, June 20, 2007. .